This story from Uganda holds great lessons for Ghana that I believe culling it from the Monitor of Uganda and relating it to the progress we have made in Ghana is very important

Over the last 18months, there has been a consistent attempt by many Governments within Sub Saharan Africa to tax mobile money and other ICT related programs and services.

Well some governments have put their tax thirst into action by the introduction of excise taxes as we have seen imposed in Kenya, Tanzania and the most recent one is Uganda. President Museveni signed into law on June 21st 2018, the Excise Duty Amendement Act 2018, which brought in the place the mobile money tax and an determined extension to social media, also called Over the Top (OTT) tax.

The law passed by the Ugandan parliament, imposed a 1 per cent tax on mobile-money transactions, including depositing, sending, receiving and withdrawal, as well as a daily Ush200 ($0.05) over-the-top tax on social media services.

After pressure from consumers, Kampala dropped three of the four levies it had imposed on mobile money transactions, and now maintains only a 0.5 per cent charge on cash withdrawals.

Impact of Mobile Money

Mobile money contributes to financial inclusion and East Africa is one of the largest mobile money markets, accounting for 56.4 per cent of total users in Sub-Saharan Africa. The service enables more efficient payments for goods and services, reduces the informal economy, creates employment and protects vulnerable segments of society from financial shocks.

The positive externalities of mobile money also drive other sectors, such as agriculture, healthcare and education and many more. In short, there are strong incentives for the Governments to support the growth of mobile money, which is the opposite of what an excise duty is typically designed to achieve. Mobile money has increased financial inclusion, particularly amongst the marginalized segments of society.

The Excise Tax (Taxation)

Excise taxes, such as those imposed in Kenya, Tanzania and Uganda, are typically used to address negative externalities. They are, for example, imposed on tobacco sales to discourage people from smoking and by driving businesses to raise the price of cigarettes. As the mobile sector is associated with overwhelmingly positive externalities, the same rationale cannot and should not apply.

In Tanzania, for example, 46% of mobile money users are below the poverty line. The negative impact of taxing mobile money transactions is likely to fall most heavily on these individuals.

Tax Impact for Uganda

Officials from the Bank of Uganda, this week have called the tax discriminative following their engagement with the Finance Committee on Parliament to update legislators on the performance of the mobile money tax.

The officials explained that the mobile money tax, within the first two weeks of implementation has recorded a decline in mobile money transactions with an associated value loss of $182million.

Director of statistics at the Bank of Uganda, Mr. Charles Abuka explained that comparing June against July performance speaks to the loss impact they have recorded in monetary terms. He further proposed that the tax policy, in general, be reviewed by making it broad-based to encourage sectors that are growth points like mobile money.

“It is not always the case that high taxes helps to generate revenue; it might be the case that when you lower them, you get more advantages that can have positive impacts on government revenue,” Mr Abuka said.

Mobile Network operators and mobile money agents have kicked against the policy since March 2018, citing that the tax will make their business extinct. The CEO of MTN Uganda, Mr. Wim Vanhelleputte has said “the MTN business dropped by 30% following the tax introduction on Mobile Money. Our estimations are that if the existing tax regime remains unchanged, we will continue going down further maybe even 35 per cent or even 40 per cent by the end of the year.”

MTN Uganda has said mobile money agents who number about 150,000 in the country are getting 40% less of what they used to earn, and that they now have to pay a 10% withholding tax, which was not the case before.

Financial experts have said, taxing the movement of money discourages trade and commerce, it discourages the formalization of the economy and it interferes with financial intermediation.

Francis Kamulegeya, a UK trained Chartered Tax Adviser and Certified Public Accountant, has said that the Mobile Money tax undermines the progress and successes made in the country in respect of financial inclusion. It hurts the poorest most, and this is already evident on the basis of the impact the tax has had in just five days. It will result in massive loss of employment, both direct and indirect employment in the mobile money sector, it will discourage people from using mobile money services and it will increase the cost of doing business in Uganda

Conclusion

Lessons from Uganda clearly show consumers have lost trust in the mobile money system and are reverting to banks, or heavy use of cash transactions, which once again deepens the informal economy while discounting gains to enhance financial inclusion.

Mobile Money in many markets in Africa is at a nascent stage despite huge volumes and values recorded by Central Banks. Taxing any of these markets undermines the investment case at a time when mobile operators are already under significant cost pressure to expand networks, improve service quality, and address new regulatory requirements.

Governments will have to explore broad-based alternatives to mobile money taxation as it rather stands to deliver better results. For us in Ghana, this holds great of lessons for us. This is why Ghana Chamber of Telecommunications has always advocated caution, that as a people we need to be extremely careful and strategic when it comes to imposing new taxes on these digital services! It validates our school of thought that we should not focus on front-loading taxation but rather on encouraging the use of Mobile Financial Services to engender production and in the long term to grow revenues. It is good that the Ghanaian Government has resisted the temptation to impose taxation on mobile money, OTT or other data services.

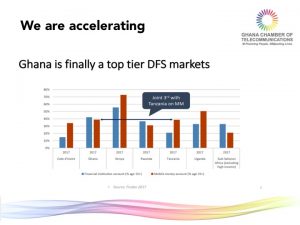

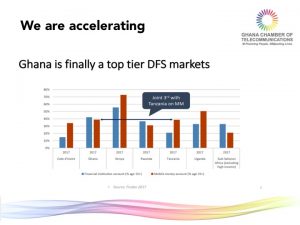

I pray that we never end up here where Uganda, Shs672 billion in two weeks, and sacrifice all the hard work that the industry and its regulator Bank of Ghana have built, including Ghana moving to the joint third position with Tanzania who were previously way ahead of Ghana, (World Bank Findex report). If Uganda does not take steps to correct this taxation anomaly Ghana will overtake them in the near future.

It is important that we point to those fixated on taxation of MoMo and other Digital Services to see the Telecom sector rather as a Cash Horse pulling the cart of the economy up the steep hill of development that needs caring for and grooming to unleash its maximum sustainable potential, than a Cash Cow that has to be unsustainably milked to death.

Source: Article written by Ghana Chamber of Telecommunications

http://telecomschamber.com/